Latest Blog:

AI Powered Dashboard are Live

BFSI 360 Analytics Suite delivers the clarity, speed, and strategic insight modern banks and financial institutions need. It connects data across credit card, merchant, and CASA operations, empowering leadership with real-time intelligence to drive profitability, reduce risk, and plan smarter.

87% of financial leaders say siloed data slows performance and oversight.

BFSI 360 connects credit card, CASA, merchant, and compliance data into one executive view for confident, cross-functional decisions. .

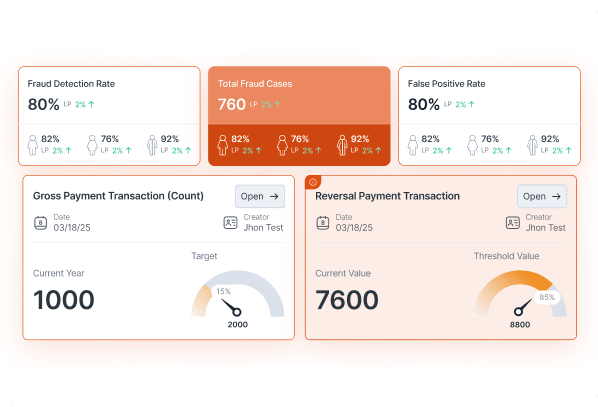

Institutions using real-time analytics report up to 42% faster incident detection and response.

BFSI 360 empowers risk and fraud teams to act early with predictive signals and reduce potential impact..

Disconnected reporting leads to gaps in execution across functions.

BFSI 360 aligns operations, finance, and compliance leaders with shared, role-based dashboards to streamline collaboration.

Banks reduce planning cycles by up to 48% using predictive intelligence.

BFSI 360 supports scenario planning, resource allocation, and KPI tracking—all in one agile platform.

BFSI 360 is a next-generation banking intelligence platform designed for executive decision-making. It integrates real-time data across the credit card lifecycle, merchant acquirer operations, and CASA performance into one unified, AI-enabled environment.

From tracking revenue leakage and delinquency to improving merchant retention and deposit growth, BFSI 360 replaces fragmented reporting with clear, actionable insight. It empowers financial institutions to lead with data precision, scale smarter, and deliver measurable impact across every unit.

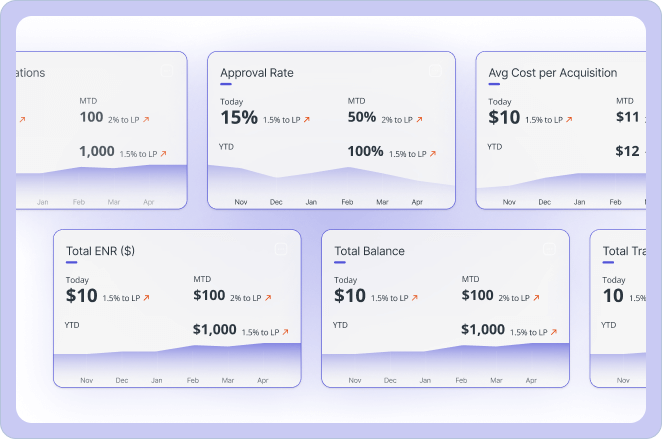

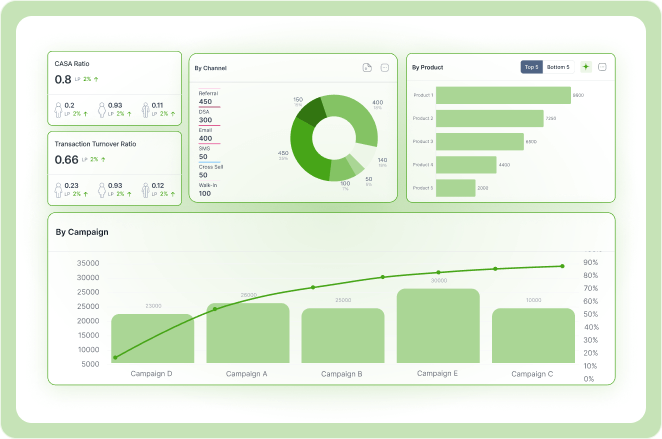

Gain visibility into the full lifecycle of credit card portfolios to manage revenue, risk, and retention.

Track customer onboarding, transaction trends, and delinquency risk in one streamlined dashboard.

Identify top-performing segments, revenue leakage, and loyalty opportunities to optimize growth.

Surface high-risk behaviors and potential fraud trends before they affect bottom-line performance.

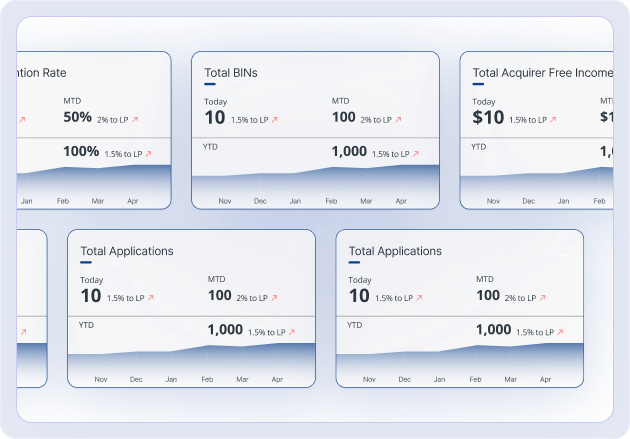

Optimize merchant relationships and revenue with end-to-end visibility into acquiring operations.

Track BINs acquired, retention rates, and fee income at a glance to guide portfolio strategy.

Understand profitability by merchant category and align fees with performance drivers.

Get instant insights into acquiring revenue, churn risk, and underperforming segments.

Strengthen your core deposit base with real-time CASA metrics and predictive churn analytics.

Monitor deposit flows and growth trends across customer segments and regions.

Use advanced indicators to identify early signs of attrition and take timely action.

Understand transaction patterns to optimize account strategies and engagement models.

Stay ahead of financial and operational risks with real-time threat alerts and anomaly detection.

Configure thresholds for fraud, revenue dips, or unusual customer activity.

Scan all key metrics for sudden deviations and escalate only what matters.

Get a unified view of threats across Issuer, Acquirer, and CASA domains.

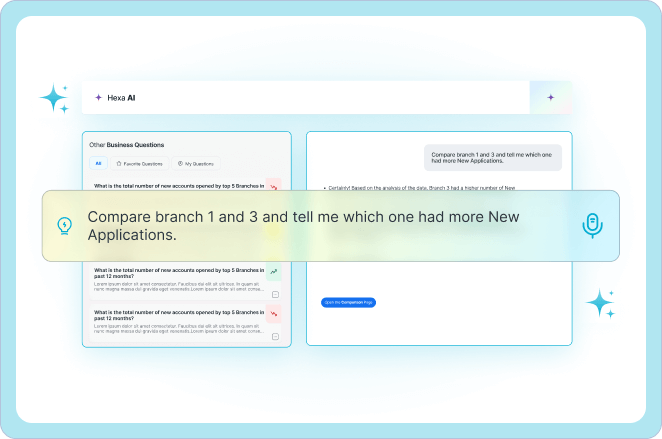

Turn natural language into powerful insights with Hexalytics' built-in AI assistant.

"Why is churn increasing in Tier 1 cities?" — get a dashboard answer in seconds.

Empower executives and teams to explore insights without technical training.

Make planning faster and smarter with on-demand, AI-powered answers.

Consolidates siloed data from Issuer, Acquirer, and CASA systems into a unified architecture—streamlining access, governance, and analysis.

Provides real-time KPIs and performance dashboards tailored for leadership—enabling alignment across risk, revenue, and growth teams.

Leverages anomaly detection, trend deviation alerts, and configurable thresholds to surface risks before they affect operations.

Enables rapid querying through natural language using Hexa AI—turning complex financial queries into instant insights for faster strategy refinement.

Hexalytics Pulse pushes critical updates to smart devices—allowing decision-makers to act on live metrics outside the office.

Transit 360 supports multiple roles:

Transit 360 follows Hexalytics’ belief that analytics should serve leadership first. The platform focuses on clarity, decision readiness, and outcomes rather than dashboards for their own sake.

Hexalytics embeds AI where it adds value, such as early signal detection, trend analysis, and predictive indicators, while keeping insights transparent and explainable for public-sector leadership.

Transit 360 creates a shared source of truth across operations, maintenance, safety, and planning. This reduces conflicting reports and aligns teams around common metrics.

Whether you’re leading credit, risk, CASA, or transformation initiatives, see how BFSI 360 supports smarter, faster decisions without disrupting existing systems.

In this personalized walkthrough, we’ll: